The Financial Efficiency Advantage: How AI Receptionists Streamline Insurance, Payments, and Revenue Flow for Modern Clinics

Most clinics don’t struggle because they lack patients.

They struggle because money gets stuck inside broken processes — slow insurance verification, missed eligibility checks, billing errors, and delayed patient approvals.

Financial friction is one of the biggest hidden leaks in healthcare.

It slows the clinic down, frustrates patients, overwhelms staff, and hurts revenue.

AI receptionists fix this entire financial layer.

They streamline insurance communication, automate verification steps, and guide patients smoothly through payment and approval workflows.

As a result, clinics operate with financial clarity, faster processing, and more predictable revenue.

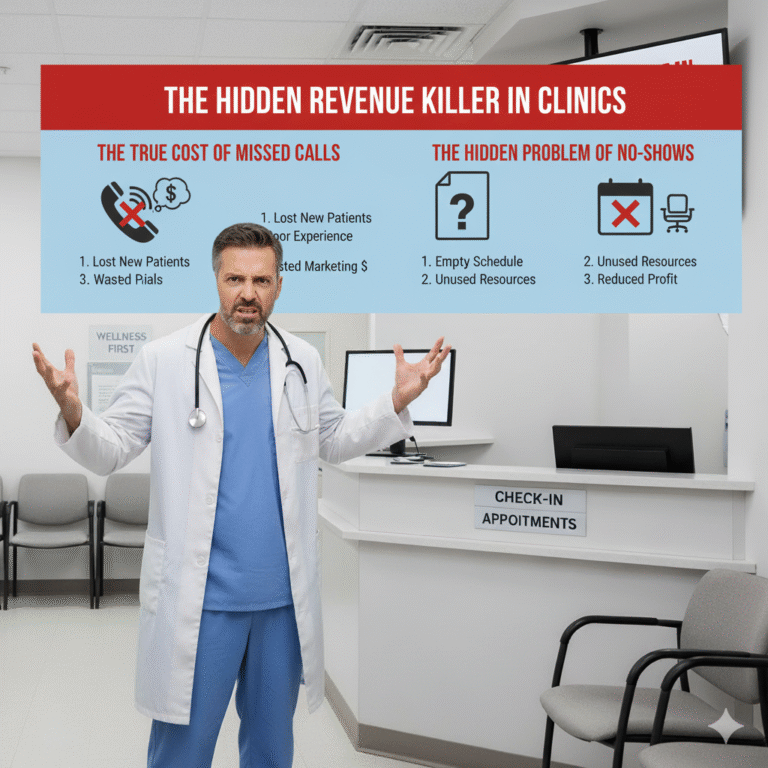

The Hidden Financial Problems Inside Clinics

Clinics don’t usually talk about financial inefficiencies, but they feel them every day.

❌ Slow insurance verification

Patients wait days for approval, causing delays and cancellations.

❌ Incorrect information from patients

Names, Emirates IDs, policy numbers — all often miscommunicated.

❌ Eligibility confusion

Patients assume they are covered when they’re not.

❌ Front desk mistakes

Staff misrecord numbers, forget follow-ups, or lose paperwork.

❌ Patients unsure about costs

Lack of clarity leads to frustration, complaints, or no-shows.

❌ Cancelled or postponed treatments

Because insurance wasn’t processed in time.

Financial friction costs clinics more than most realize.

AI receptionists remove that friction entirely.

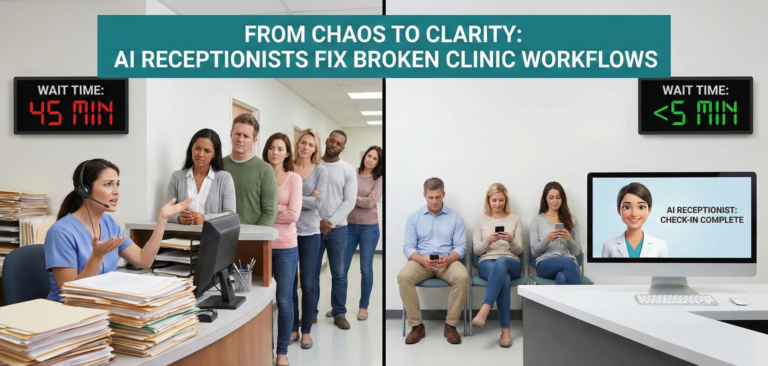

How AI Receptionists Improve Financial Efficiency

AI receptionists automate and optimize the financial workflow — ensuring smooth, accurate, and consistent insurance processing.

Here’s how they create measurable financial improvements:

⭐ 1. Automated Insurance Data Collection

AI gathers all required details before the patient arrives:

- Emirates ID

- Policy number

- Insurance provider

- Policy expiration

- Visit reason

- Previous approvals

- Required documents

Impact:

Staff don’t waste time chasing missing information.

⭐ 2. Insurance Eligibility Pre-Checks

AI can perform initial eligibility validations or trigger the verification process instantly.

Impact:

Patients know coverage status BEFORE arriving — reducing frustration and cancellations.

⭐ 3. Real-Time Patient Guidance

AI explains payment options clearly:

- Co-pay

- Deductibles

- Procedures covered

- Cash packages

- Insurance limitations

Impact:

Patients understand costs → trust increases → fewer billing disputes.

⭐ 4. No More Documentation Errors

AI captures and records insurance details with zero mistakes — multilingual and perfectly accurate.

Impact:

Fewer claim rejections and reduced admin workload.

⭐ 5. Automated Pre-Approval Follow-Ups

AI follows up with the clinic or insurer automatically:

- “Is approval ready?”

- “Is the report uploaded?”

- “Has the patient been notified?”

Impact:

Faster approvals → quicker treatments → smoother cashflow.

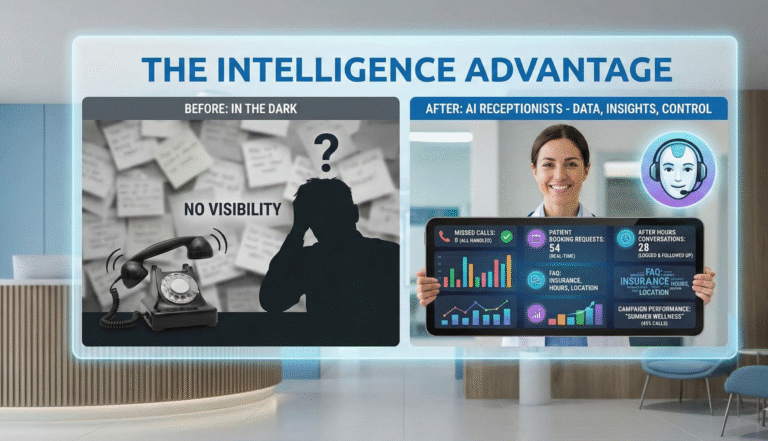

⭐ 6. Financial Transparency for Managers

AI-generated dashboards show:

- How many approvals are pending

- Time taken per case

- Common reasons for rejection

- Follow-up performance

- Patterns that slow revenue

Impact:

Financial bottlenecks become visible and fixable.

⭐ 7. Reduced No-Shows for Insurance Patients

AI sends automated reminders:

- “Your approval is ready.”

- “Your co-pay is AED ___.”

- “Your appointment is confirmed.”

Impact:

Patients show up prepared and on time.

Real UAE Clinic Example: Faster Approvals = Higher Revenue

A large clinic in Dubai struggled with insurance workflow delays:

- Approvals took 2–5 days

- Staff overwhelmed by paperwork

- Patients cancelled treatments

- Doctors lost revenue

After bringing in an AI receptionist:

- Insurance data collected automatically

- Eligibility checks triggered instantly

- Patients updated in real time

- Staff workload reduced by 60%

- Approvals completed 22–40% faster

- Billing disputes dropped dramatically

Result:

Revenue increased because financial friction disappeared.

Why Financial Efficiency Matters More Than Ever

In a competitive market like the UAE, patients move FAST.

If insurance verification is slow or unclear, they simply choose another clinic.

AI receptionists protect clinics by ensuring:

- Smooth approvals

- Clear payment instructions

- Accurate documentation

- Faster processing

- Higher patient satisfaction

Financial clarity = higher trust = higher retention.

How AI Strengthens Patient Trust Through Financial Transparency

Patients don’t just want medical clarity — they want financial clarity.

AI gives them:

- Clear cost explanations

- Step-by-step insurance instructions

- Multilingual details

- Real-time updates

- Zero misunderstandings

This transparency reduces:

- Confusion

- Anxiety

- Complaints

- Delays

- Disputes

Patients trust clinics that communicate openly and clearly.

AI makes this consistent.

The Future: AI-Powered Financial Workflows in Healthcare

Over the next decade, clinics will automate more of their financial operations:

- Eligibility checks

- Approval tracking

- Cost explanations

- Payment plans

- Benefit investigations

- Patient follow-ups

AI receptionists will be at the heart of this system — ensuring fast, error-free communication between patients, clinics, and insurers.

The clinics that adopt early will enjoy smoother workflows, lower costs, and higher revenue.

Bottom Line

Insurance delays, miscommunication, and documentation errors cost clinics thousands every year.

AI receptionists fix these problems by delivering:

- Accurate data collection

- Faster approvals

- Multilingual communication

- Transparent cost explanations

- Automated reminders

- Financial clarity

- Smoother patient journeys

AI receptionists are the engine of financial efficiency in modern healthcare.

👉 Want to streamline insurance workflows and accelerate your clinic’s revenue? Contact JTM Ai today and transform your financial operations with AI.